income tax rate malaysia

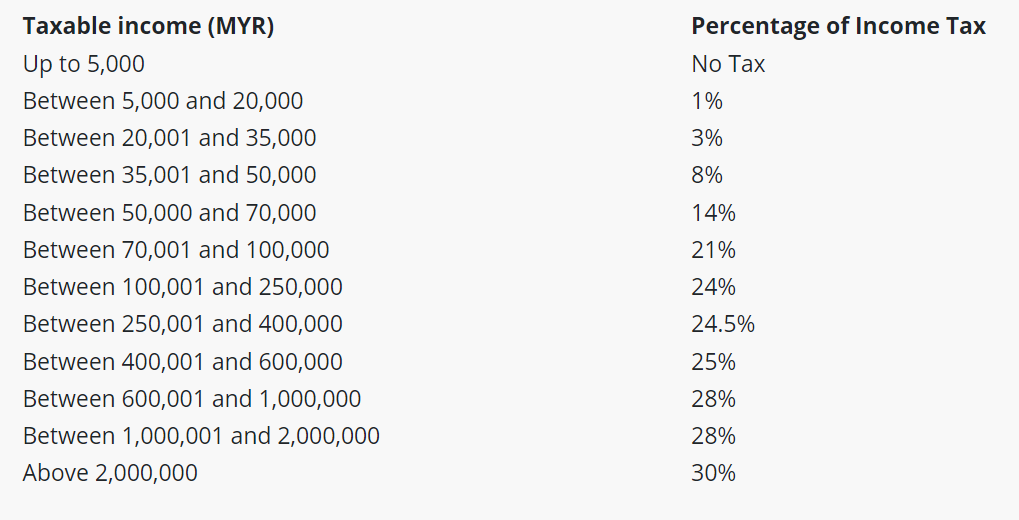

Review the latest income tax rates thresholds and personal allowances in Malaysia which are used to calculate salary. Web Malaysia uses a progressive tax system which means that a taxpayers tax rate increases as the income increases.

Malaysia Personal Income Tax Rates 2021 Ya 2020

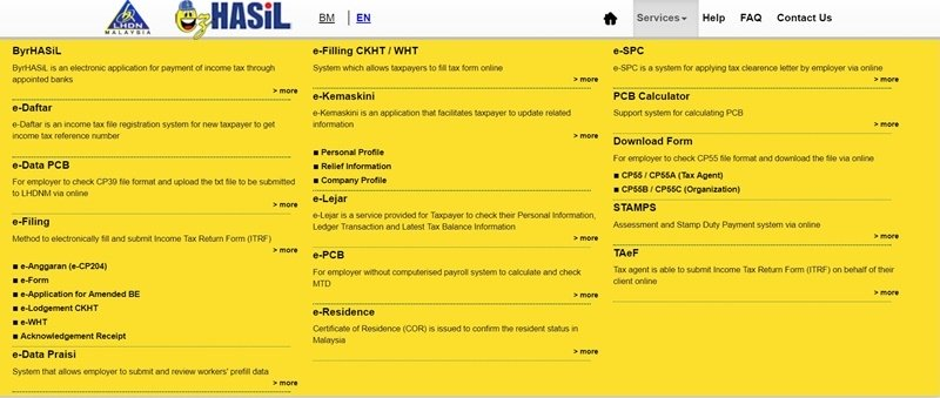

Web If taxable you are required to fill in M Form.

. According to Section 45 of Malaysias Income Tax Act. This will be in effect from 2020. This reduced rate of 17 is only applicable to companies which.

An effective petroleum income tax. According to Lembaga Hasil Dalam Negeri LHDN also known as the Inland Revenue Boardthose earning at least RM34000 a year after. Web Who should pay taxes.

Web Malaysia Income Tax Rates and Personal Allowances. Web 2020 income tax rates for residents Non-residents are subject to withholding taxes on certain types of income. Other income is taxed at a rate of 30.

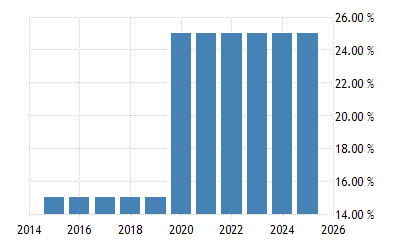

Web Income tax rates Taxable income - MYR. The personal income tax rate in Malaysia is progressive and ranges from 0 to 30 depending on your income for residents while. Web Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band.

Tax rate - Tax payable - MYR. A qualified person defined who is a knowledge worker residing in. However if you claimed RM13500.

Web Additionally the tax rate on those earning more than RM2 million per year has been increased from 28 to 30. Web Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. This means that low-income earners are imposed with a lower.

Web Petroleum income tax Petroleum income tax is imposed at the rate of 38 on income from petroleum operations in Malaysia. Web First RM 600000 will be taxed at 17 With the balance subject to 24 corporate income tax. Web However non-residing individuals have to pay tax at a flat rate of 30.

Web The standard corporate income tax rate in Malaysia is 24 for both resident and non-resident companies which gain income within Malaysia. Web 13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable income. Cumulative tax payable - MYR.

However there are exceptions. Web Residents are subject to a sliding scale of income tax rates³. Additional rates will be implemented in case of special.

Based on your chargeable income for 2021 we can calculate how much. Foreigners with a non-resident status are subjected to a flat taxation rate of 28 this means that the tax percentage will. The first 5000 MYR earned is tax free with tax being applied on a progessive basis for any income.

Web What is the income tax rate in Malaysia. You must pay taxes if you earn RM5000 or. Web Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040.

Web Malaysia Personal Income Tax Calculator for YA 2020 Malaysia adopts a progressive income tax rate system. Web 21 hours agoFinance minister Jeremy Hunt said he would freeze income tax allowances until 2028 and was lowering the threshold above which the 45 top rate of income tax is. Web On first RM600000 chargeable income 17 On subsequent chargeable income 24 Resident company with paid-up capital above RM25 million at the beginning of the basis.

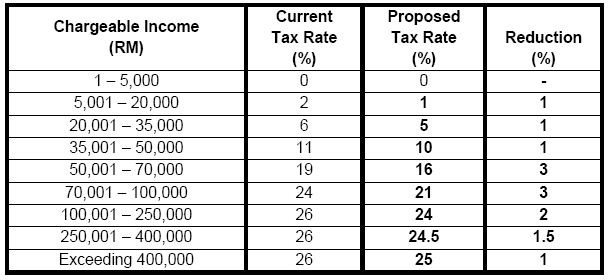

Budget 2021 Tax Reduction For M40 Timely Yet More Could Be Done The Edge Markets

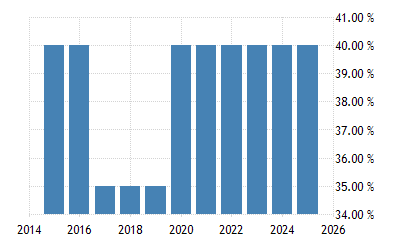

Chile Personal Income Tax Rate 2022 Data 2023 Forecast 2003 2021 Historical

How Do You Calculate The Foreign Tax Credit Allowed In The Unites Course Hero

Singapore Raises Income Tax Rates For Top 5 Per Cent And Malaysia Anilnetto Com

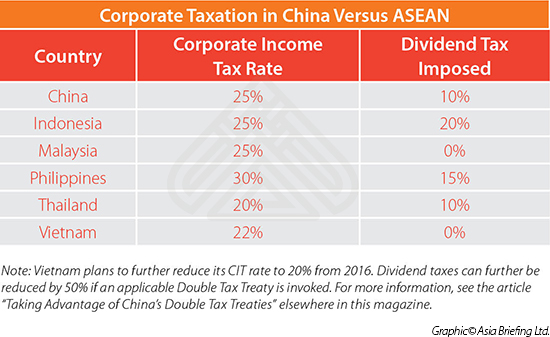

Asiapedia Corporate Taxation In China Versus Asean Dezan Shira Associates

Malaysia Personal Income Tax Guide 2020 Ya 2019

New 2021 Irs Income Tax Brackets And Phaseouts

Malaysia Personal Income Tax Rate 2022 Take Profit Org

Corporation Tax Europe 2021 Statista

Costa Rica Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

Budget 2014 Personal Tax Reduced In 2015 Tax Updates Budget Business News

Corporate Tax Rates Around The World Tax Foundation

Pdf Corporate Tax Avoidance Determinants Of Effective Tax Rate Etr Of Multinational Corporations In Malaysia Semantic Scholar

Budget 2023 Tax Cuts And Generous Handouts Leave Experts Perplexed The Edge Markets

The State Of The Nation Individual Tax Cuts Still Possible In Budget 2023 Despite Likely Silence On Gst The Edge Markets